● May 16th is “Travel Day” Actual usage data of “Overseas Travel Insurance”│More than 60% of the reasons for signing up for overseas travel insurance were “I felt that insurance with credit cards alone was not enough coverage” (Oricon Customer Satisfaction(R) Survey)

Oricon Co., Ltd. Press release: May 13, 2025 ●May 16th is “Travel Day” Actual data on the usage of “Overseas Travel Insurance”│More than 60% of the reasons for taking out overseas travel insurance were “I felt that insurance with a credit card was not enough” (Oricon Customer Satisfaction (R) Survey) The most common compensation actually applied during overseas travel was “damage to belongings” at 46.5% Oricon Co., Ltd. (Headquarters: Minato-ku, Tokyo; President and CEO: Hisashi Koike; abbreviation: Oricon) announced the actual usage data on May 13, 2025 (Tuesday) at 2:00 p.m., which its group company Oricon ME Co., Ltd., separately interviewed and compiled from 997 people surveyed for the “Overseas Travel Insurance” satisfaction ranking, which was conducted as a third party among actual service users. May 16th is known as “Travel Day,” which comes from the day on which Matsuo Basho is said to have set out on his journey to the “Oku no Hosomichi.” This time, in conjunction with this “Travel Day,” we would like to introduce the results of a survey regarding “overseas travel insurance.” The results are as follows. <Survey questions & TOPICS> ■Reasons for purchasing overseas travel insurance ・The most common answer (62.3%) was “I felt that insurance with a credit card was not enough to cover me” ■Compensation details applied for overseas travel ・46.5% of respondents applied for “Damage to personal belongings,” while others applied for “Aircraft checked baggage delay costs, etc.” ■“Application status by country” Overseas travel insurance “Where and for what” did you use it? ・In Hawaii, South Korea, and the United States (mainland), there is a tendency for a high percentage of “treatment costs (illness)” to be applied In France, 61.8% of people applied for “damage to personal belongings”, the highest number *The composition ratio is rounded to the second decimal place, so the total may not necessarily add up to 100. [Reasons for purchasing overseas travel insurance] ■The most common response (62.3%) was “I felt that insurance with a credit card was not enough to cover me”

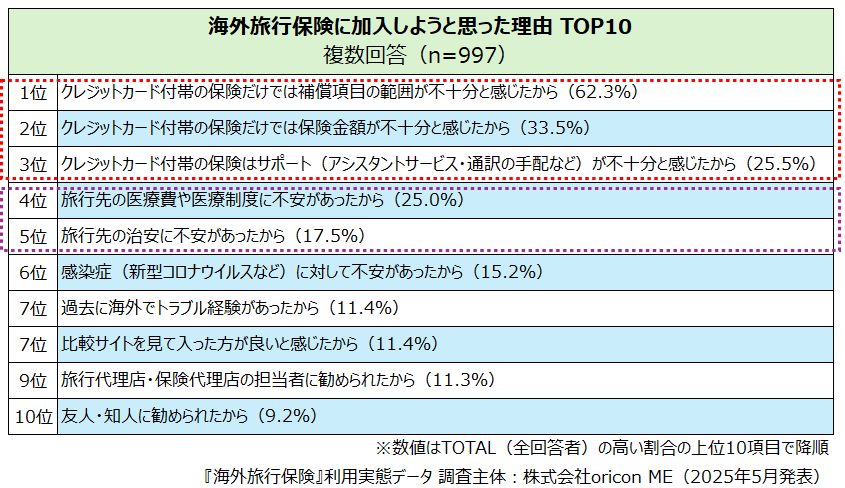

https://prcdn.freetls.fastly.net/release_image/34467/622/34467-622-d185de662cfc84c8467f739779d4e964-845×488.png “Top 10 reasons why I decided to take out overseas travel insurance” actual usage data (Oricon customer satisfaction survey) When 997 people who actually purchased overseas travel insurance and applied for compensation were asked about their reasons for purchasing overseas travel insurance (multiple answers allowed), the most common response (62.3%) was “I felt that the coverage provided by the credit card insurance alone was insufficient.” This was followed by “I felt that the amount of insurance provided by credit card insurance alone was insufficient” (33.5%) and “I felt that the support provided by credit card insurance was insufficient” (25.5%).The top respondents said they purchased overseas travel insurance from an insurance company because they were “uneasy with credit card insurance alone”. In addition, there were a certain number of reasons related to the destination, such as “I was worried about the medical costs and medical system at the destination” (25.0%) and “I was worried about the safety of the destination” (17.5%). 【Compensation details applied for overseas travel】 ■46.5% of respondents applied for “Damage to personal belongings,” while others also applied for “Costs for delayed baggage, etc.”

https://prcdn.freetls.fastly.net/release_image/34467/622/34467-622-9c3593241fa773f4bc396f734e985cf6-736×482.png “Top 5 coverages applied for overseas travel insurance” actual usage data (Oricon customer satisfaction survey) When asked about the “coverage details applied during overseas travel (multiple answers allowed)”, “Damage to belongings (compensation for stolen or damaged belongings)” was the most common response at 46.5%. This was followed by “medical treatment costs (illness)” (36.6%), “medical treatment costs (injury)” (29.4%), and “aircraft delay costs” (16.3%). Also, under “Other,” there was “Aircraft Checked Baggage Delay

Expenses,” which compensates for the cost of clothing, daily necessities, and personal items purchased during the trip if the baggage checked in with the airline is delayed. [“Applicability status by country” Overseas travel insurance “where and for what” did you use it] ■In Hawaii, South Korea, and the United States (mainland), there is a tendency for a high percentage of people to be covered by “medical expenses (illness)” / In France, 61.8% of people are covered by “damage to belongings”

https://prcdn.freetls.fastly.net/release_image/34467/622/34467-622-a6bcbe36b865eac8babf89f01d8ee91e-673×507.png “Compensation applied by travel destination” usage data (Oricon customer satisfaction survey) When we multiplied the top 5 items of “Destinations covered by overseas travel insurance (multiple answers)” and the top 5 items of “Coverage contents applied during overseas travel (multiple answers)”, we found that in Hawaii (46.6%), South Korea (42.0%), and the United States (mainland) (38.6%), the percentage of people who used coverage for “medical expenses (illness)” tended to be higher among the top 5 countries covered by insurance. On the other hand, in France, 61.8% of respondents applied for “damage to personal effects,” which was relatively high among other types of compensation. In addition, in Taiwan, the percentage of people who used compensation for “aircraft delay costs” was 28.4%, a relatively high result compared to other travel destinations. ―――――――――――――――――――――――――――――――――――――――――――― 《Survey Overview》 2025 Oricon Customer Satisfaction (R) Survey Overseas Travel Insurance Usage Data ■Announcement date: 2025/05/13 ■Research subject: oricon ME Co., Ltd. ■Research method: Internet survey ■Number of samples: 997 people ■Survey period: 2025/01/07-2025/01/24 ■Survey target Gender: Not specified Age: 18-84 Region: Nationwide Conditions: People who meet all the conditions below 1) Traveled overseas for sightseeing purposes after May 2023 and purchased overseas travel insurance 2) Apply for overseas travel insurance and receive insurance money 3) Involved in the selection of overseas travel insurance companies and understands the payment amount for services

――――――――――――――――――――――――――――――――――――――――――――

This article was partly generated by AI. Some links may contain Ads. Press Release-Informed Article.